The total income tiers and their tax rates are as follows: Before 2007, the California Franchise Tax Board claimed that it could tax a California LLC's income from anywhere in the world, but courts adjusted the law. The state of California defines total income as the total revenues the company gets from California. Unlike the calculations for the tax rates of corporations, both the LLC fee and LLC tax are not dependent on profits. In addition to the static LLC tax, there is a variable LLC fee which increases as the total income of the LLC goes up. Even inactive businesses keep accumulating the tax as long as they are still registered with the California secretary of state. This amount is levied on most domestic and foreign LLCs registered in California, whether they did business in that tax year or not. The California Franchise Tax Board explains that the tax is charged for the "privilege of conducting business in California." Each LLC is charged a minimum LLC tax of $800. Franchise TaxĬalifornia Franchise tax is charged on most businesses in the state including corporations, LLCs, and partnerships. This double taxation, relatively high tax rate, and the possibility of taxing LLC owners on some profits the owners that are directly reinvested in the business stack the odds against small businesses in California. LLCs are not subject to corporate tax because they have pass-through status but are subject to a number of California state taxes on the personal income of the owners. A California LLC is by default treated as a disregarded entity if it has one member or a partnership if it has more than one member. Most businesses are subject to two or three of these taxes. California State Taxes and the LLCĬalifornia has three types of taxes on business: corporate tax, franchise tax or an alternative minimum tax, and income tax. The rates for sales tax and Nonconsenting Nonresident members' tax vary depending on the location of the LLC and the people involved. Even though the IRS is changing Form W-4 starting in 2020, if you don't submit a new W-4 after 2019, your employer will continue to use the information from your pre-2020 W-4 to calculate your withholding.California LLC tax rates are $800 for LLC tax, an LLC fee that ranges from $0 to $11,790, and FICA tax at 15.3% of taxable wages. Look for changes to how withholding amounts are computed starting in 2020, but in the meantime we have a handy tax withholding calculator that can help you nail down your withholding for the rest of 2019.

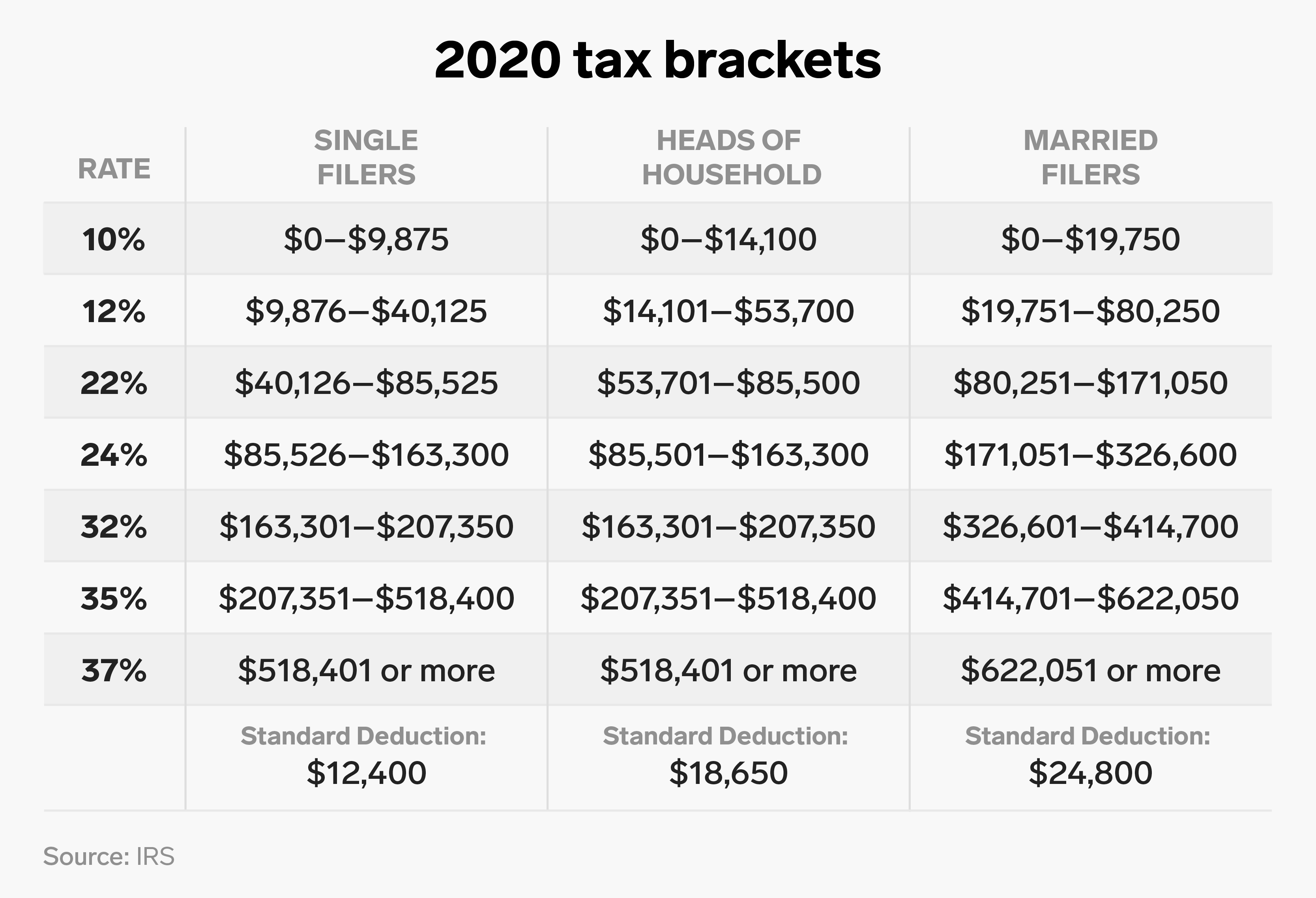

They were eliminated by the 2017 tax reform law.īy the way, it's always a good idea to check your income tax withholding each year-especially, if you're moving into a different tax bracket or experience some other significant shift in your financial situation. For anyone who is both 65 and blind, the additional deduction amount is doubled.Īs in 2019, personal exemption deductions aren't allowed for 2020. Taxpayers who are at least 65 years old or blind can claim an additional standard deduction of $1,300 ($1,650 if using the single or head of household filing status). 2020 Tax Brackets for Married Filing Separately/Head of Household Since the IRS is using lower inflation adjustments, then the chances that your income will grow faster than the IRS's rate of inflation rise. Why? If your income increases faster than the rate of inflation, you eventually move up to a higher bracket. As a result, the 2017 tax reform law adopted the "chained" CPI formula that the IRS now uses.Ĭhained indexing generally results in lower inflation adjustments to the tax brackets each year, which in turn means you could find yourself in a higher tax bracket on your next return. However, some economists believed that formula didn't fully account for changes in spending as prices rise.

Before 2019, the standard Consumer Price Index was used to adjust the brackets. One other thing to note is that Congress recently changed the indexing method used to adjust the tax brackets for inflation.

0 kommentar(er)

0 kommentar(er)